Table of Contents

Introduction to the Zig Zag Indicator

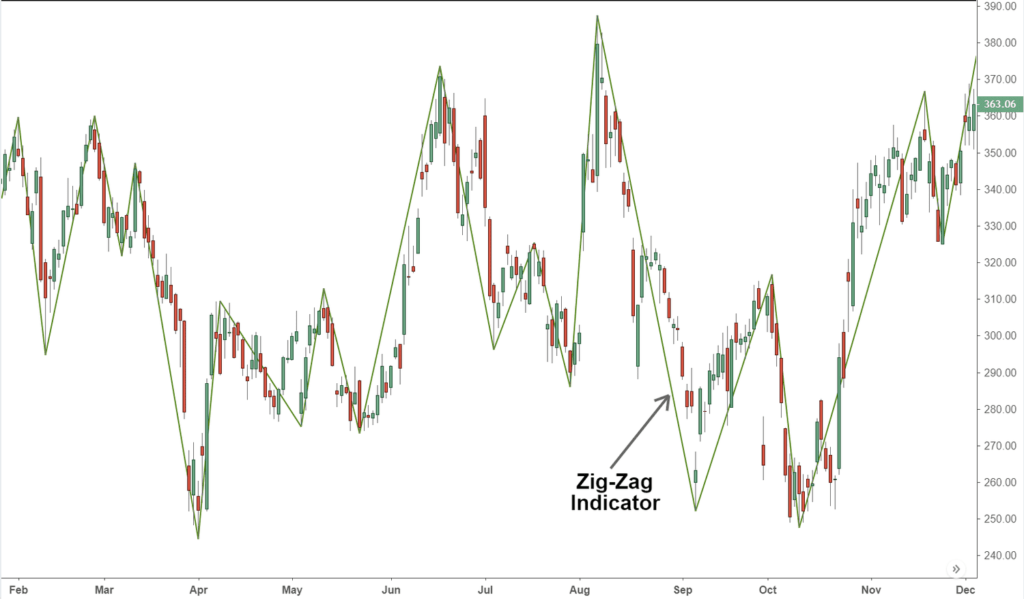

The Zig Zag Indicator is a crucial tool within the realm of technical analysis, designed to filter out insignificant price movements and emphasize substantial trends and reversals. By focusing on key market shifts, it allows traders to gain a clearer understanding of price action, making it easier to identify potential trading opportunities. The indicator accomplishes this by connecting significant price points, thereby eliminating the noise created by minor price fluctuations.

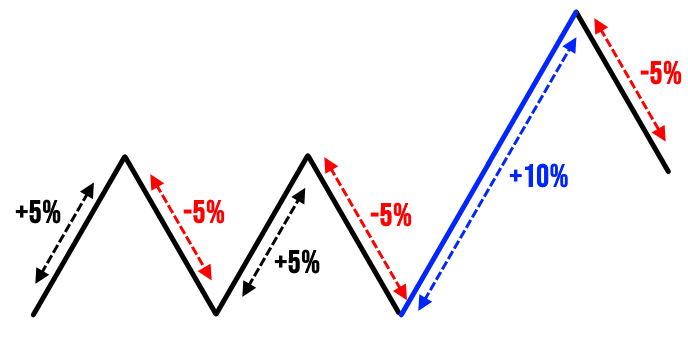

Mathematically, the Zig Zag Indicator is calculated by setting a percentage threshold that price movements must exceed to be considered significant. For example, if the threshold is set at 5%, only price changes greater than this value will be plotted on the chart. This method helps in highlighting the primary trends while smoothing out the smaller, less relevant price movements. The resultant lines, often referred to as ‘zigzags’, visually simplify the chart, making the underlying trend more apparent.

The Zig Zag Indicator has its roots in the early development of technical analysis, a field pioneered by traders and analysts looking for systematic ways to interpret market data. Over time, the indicator has evolved, integrating more sophisticated algorithms and computing power to enhance its accuracy and reliability. Despite these advancements, the core principle remains the same: to distill the market’s movements into a more comprehensible form.

Within the broader context of technical analysis, the Zig Zag Indicator holds a unique position. Unlike other indicators that might focus on momentum or volume, the Zig Zag Indicator is purely price-centric. Its primary purpose is to delineate market trends by visually simplifying the price action. By doing so, it assists traders in identifying key support and resistance levels, trend reversals, and other critical market phenomena. This enhanced clarity can be particularly beneficial for those who employ trend-following strategies, as it allows for more informed decision-making.

Setting Up the Zig Zag Indicator on Trading Platforms

The Zig Zag Indicator is a versatile tool that can be set up on various trading platforms pocket option signal, including MetaTrader and TradingView. To begin, open your chosen platform and navigate to the indicators section. In MetaTrader, this can be accessed through the “Insert” menu, followed by “Indicators,” then selecting “Custom,” and finally “Zig Zag.” In TradingView, click on the “Indicators” icon, search for “Zig Zag,” and select it from the list.

Once the Zig Zag Indicator is added to your chart, you will need to configure its parameters. The primary customizable settings include percentage move, deviation, and depth. The percentage move parameter determines the minimum price change required for the indicator to plot a new point. For instance, setting this to 5% means that the price must move at least 5% from the previous high or low to form a new Zig Zag line.

Deviation refers to the minimum reversal amount, expressed as a percentage, needed to change the direction of the Zig Zag line. Depth, on the other hand, specifies the number of bars that must be considered for the calculation of the Zig Zag points. Adjusting these parameters allows traders to tailor the indicator to their specific trading style and market conditions. For example, short-term traders might prefer a lower depth setting to capture more frequent price swings, while long-term traders might opt for a higher depth setting to filter out minor fluctuations.

To integrate the Zig Zag Indicator with other technical analysis tools, consider combining it with moving averages, Fibonacci retracement levels, or trend lines. This multi-faceted approach can enhance the effectiveness of your trading strategy. For instance, using the Zig Zag Indicator in conjunction with moving averages can help identify potential entry and exit points, while Fibonacci retracements can provide additional confirmation of support and resistance levels.

By customizing the Zig Zag settings and integrating it with other analytical tools, traders can develop a more robust and informed trading strategy, ultimately leading to more effective trading decisions.

Implementing the Zig Zag Indicator Strategy

The Zig Zag Indicator is an essential tool for traders, offering a clear depiction of price movements by filtering out minor fluctuations. This makes it particularly useful for identifying entry and exit points, as well as support and resistance levels within a trading strategy pocket option course. One of the primary applications of the Zig Zag Indicator is to highlight significant trend reversals, allowing traders to make informed decisions based on the broader market direction.

To effectively implement the Zig Zag Indicator strategy, traders should start by configuring the indicator’s parameters to suit their trading style. Typically, the Zig Zag Indicator is set with a percentage threshold that defines the minimum price movement required for a new line to be drawn. A common setting might be 5%, but this can be adjusted based on the volatility of the market being traded.

Once the indicator is set, traders can identify entry points by looking for the beginning of a new Zig Zag line in the direction of the prevailing trend. For exit points, the end of a Zig Zag line may signal the conclusion of a trend or a significant retracement. Support and resistance levels can also be discerned by observing the peaks and troughs formed by the Zig Zag lines, as these often correspond to historical price levels where the market has previously reversed.

Combining the Zig Zag Indicator with other technical analysis tools can further enhance its effectiveness. For instance, integrating Fibonacci retracements can provide additional confirmation of potential reversal points, as the Zig Zag lines often align with key Fibonacci levels. Similarly, moving averages can be used in conjunction with the Zig Zag Indicator to confirm trend directions and filter out false signals.

Consider a hypothetical trading scenario where a trader uses the Zig Zag Indicator in combination with a 50-day moving average. Suppose the market is in an uptrend, and the Zig Zag Indicator signals a new upward line while the price remains above the 50-day moving average. This could be interpreted as a strong buy signal. Conversely, if the Zig Zag Indicator shows a downward line and the price falls below the moving average, this might signal a sell or short position.

In a real-world case study, a trader might observe a stock that has formed a series of higher highs and higher lows on the Zig Zag Indicator, indicating a clear uptrend. By plotting Fibonacci retracement levels, the trader identifies potential support at the 38.2% retracement level. When the price retraces to this level and forms a new upward Zig Zag line, it reinforces the decision to enter a long position.

Overall, the Zig Zag Indicator strategy provides traders with a structured approach to navigating market trends, identifying critical turning points, and leveraging additional indicators for more robust trading decisions. By understanding and applying these principles, traders can enhance their market analysis and improve their trading outcomes.

Advantages and Limitations of the Zig Zag Indicator

The Zig Zag Indicator is a valuable tool for traders aiming to simplify complex price movements and identify key market trends. One of its primary advantages is its ability to reduce market noise, making it easier for traders to discern the underlying direction of the market. By filtering out minor price fluctuations, the Zig Zag Indicator provides a clearer view of significant price movements, which can be particularly beneficial in trending markets. This clarity allows traders to make more informed decisions and can help in identifying potential entry and exit points.

However, the Zig Zag Indicator is not without its limitations. One notable drawback is its lagging nature. Since the indicator relies on historical price data to plot trend lines, it may not always provide timely signals, potentially leading to missed opportunities. Additionally, in highly volatile markets, the Zig Zag Indicator can generate false signals, causing traders to misinterpret the market’s direction. This can result in premature trades or missed opportunities, ultimately impacting trading performance.

To mitigate these limitations, traders are advised to use the Zig Zag Indicator in conjunction with other technical analysis tools. For example, combining it with moving averages or oscillators can provide confirmation of trends and reduce the likelihood of false signals. Adjusting the indicator’s settings, such as modifying the percentage threshold for price movements, can also help tailor it to specific market conditions, enhancing its effectiveness.

When incorporating the Zig Zag Indicator into a comprehensive trading strategy, it is essential to consider the broader market context and use it as one component of a multifaceted approach. By leveraging its strengths while being mindful of its limitations, traders can enhance their ability to navigate the markets and improve their overall trading outcomes. Consistent practice and continuous learning are key to mastering the use of the Zig Zag Indicator and integrating it effectively into a robust trading strategy.